When you learn a new setup and implement it on Paper trading, it is usually smooth and easy. However it gets much more difficult when you apply the same skills in real trading. This is a very common issue.

I think there are possibly two reasons.

1. Timing.

There is no emotional stress during backtesting with historical data. You can only learn how to use the trading platform or test if your trading strategy has potential to profit (positive EV).

On Forward testing, you are doing simulated trading with realtime data. If the time you choose to forward test is the "Easy money" period, you will feel good. On the other hand, it will be a hard time during consolidation period.

2. Nervous.

You know it is a Practice, there is no win-or-loss. Therefore you can wait for the market to move without emotion.

But when it comes to real trading, there is something to lose. You start to worry for a tiny movement.

Solution to this: If you plan to risk 0.5%, do it with 0.25% or even 0.1%. Reducing the money at risk can easy your anxiety.

In real trading, if you can reach the level of performance as of practicing, try to review if you fits any situation below:

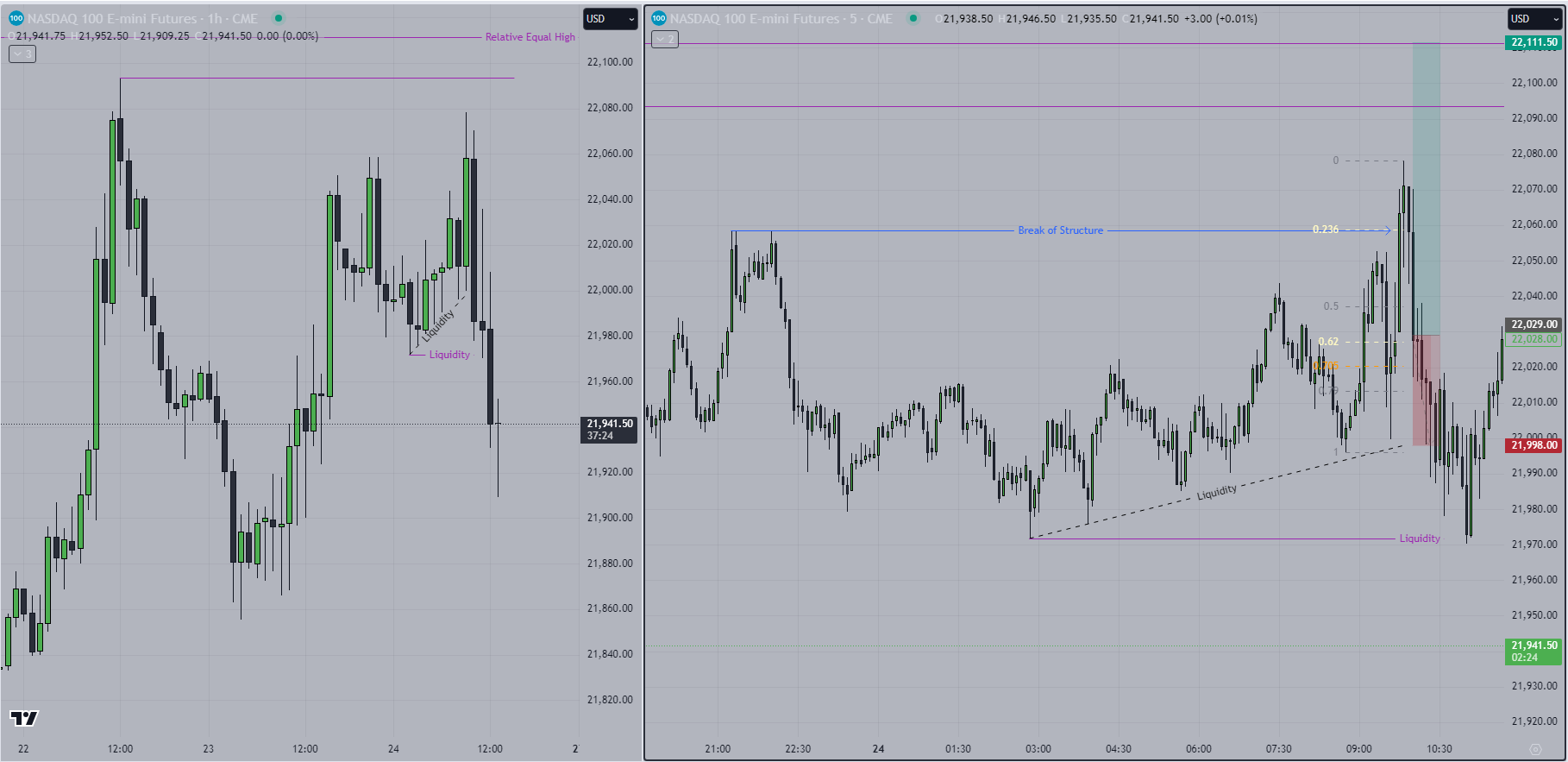

Situation 1: Price hits your Stop Loss directly.

If price always hit your stop loss, you should really think if you missed something during analysis. If your bias is a price rally in a certain timeframe but the actual is a drop, what information have you missed?

Would that be a Bearish Trend in a higher timeframe?

Situation 2: You made some profits but did not take it. Market reverse and hit your Stop Loss.

This shows your view is correct, at least partially correct.

If the trade can reach a target of "Risk Reward Ratio of 1:1" (floating profit is the same a potential stop loss), take a partial profit. You have more options now for the remaining positions: maintain the initial stop loss or move it to Break-even price. This allows you to capture the potential trend afterwards. Even if the price reverse, you still make "some profits" or "break-even".

Situation 3: Price almost reach your Take Profit but it consolidates right before hitting your TP. Then it reverse. Floating profit never realize.

This is a rather tricky situation. I hate it, but it keeps coming up all the time. "So close, yet so far". It's torture watching price move, always just a hair's breadth away.

My approach now is to partially take profit as the price approaches to the target. I was quite reluctant to use this method because it was also agonizing. For example I had planned a trade with 3:1 reward-to-risk ratio, but it ends up only 2.3:1 after partial take profit.

Later on, I realized that these "planned RRR" were missing the point altogether, which shifted my perspective and helped me appreciate the benefits of taking partial profit.

If you want to calculate the Reward-to-Risk Ratio, you should base on your actual trading data to determine the "Actual RRR", rather than relying on the "Planning RRR".