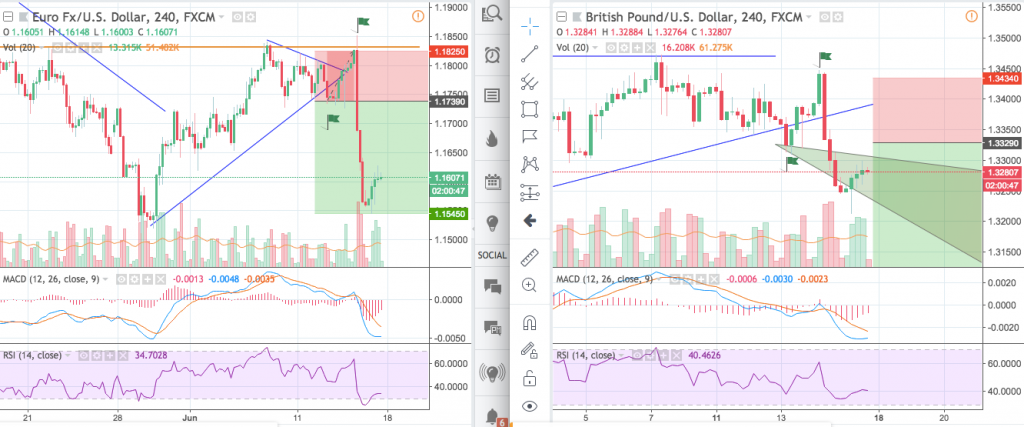

I have published two trading ideas on June/13, and both of them were closed at loss.

EURUSD, Daily, June/11-15, Short, Hit Resistance and MACD slows down

GBPUSD, Daily, June/11-15, Short, Hit Resistance

The market were nasty during the Super Week and my stop loss were hit, and resumed.

For the EURUSD, it is even harder to trade because the price breakout to the upside and then swing back to break the low.

I was away at the moment the volatility picks up. Yes I try not to stay too close to the market..

Observations:

- The trade setup is fine. (Yes, indeed)

- Market volatility is beyond my prediction.

- I pinpointed the SL price at the “top”

- I neglected the impact of market news.

Thoughts:

- FX Trading should be of short timeframe? One shouldn’t let the position open for too long? Perhaps 24-48 hours?

- Should I jump back to short the pairs when price go back to my original price. Re-initiate the same trade?

- Should I loosen the SL price?